Bollinger Bands Explained With Free PDF Download

Bollinger Bands are a widely used technical analysis tool traders and investors use to gauge market volatility, identify potential trends, and generate trading signals. Developed by John Bollinger in the 1980s, Bollinger Bands are commonly applied to various financial instruments, including stocks, commodities, and currencies.

Bollinger Bands Explained With Free PDF Download

Home Download Download Bollinger On Bollinger Bands [PDF] Type: PDF Size: 20.3MB Download as PDF I am human Privacy - Terms Download Original PDF This document was uploaded by user and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this DMCA report form.

eBooks Download Bollinger on Bollinger Bands [PDF] by John Bollinger Read Full Online "Click

Jul 16, 2021 Written by: Al Hill Bollinger Bands are a powerful technical indicator created by John Bollinger. The bands encapsulate the price movement of a stock, providing relative boundaries of highs and lows.

Bollinger bands trading methods

Bollinger Bands are a short-term trading tool that can help you decide when to make your move by assessing the relative strength—or momentum—of a stock investment. You can even apply them to the broad market. This indicator looks like an envelope that forms an upper and lower band around the price.

Bollinger Band Multiplier Ba Stock Technical Analysis Analítica Negocios

2.1 Trading Bands To introduce the approach this paper will take towards measuring profitability, we will examine the concept of trading bands. Trading bands envelop the price structure of an asset. Graphically, these trading bands would appear to be constraints on the asset's value throughout time, but this is not so.

Nadex Bollinger Bands Multicharts User Guide Pdf The Waverly Restaurant on Englewood Beach

Bollinger Bands and the rolling regression time series model. In Section 4 we describe how Bollinger Bands can be used in pairs trading as a mechanism for capturing the mean reversion behavior 2The application of Bollinger Bands to pairs trading will be discussed in detail in Section 4. 3.

Bollinger Bands Explained With Free PDF Download

Bollinger Bands® is a technical analysis tool to generate oversold or overbought signals and was developed by John Bollinger. Three lines compose Bollinger Bands: A simple moving average,.

bollinger bands forex pdf Forex trading, Band, Technical analysis charts

Bollinger on Bollinger Bands John Bollinger McGraw Hill Professional, Aug 21, 2001 - Business & Economics - 288 pages John Bollinger is a giant in today's trading community. His Bollinger.

Bollinger Bands Explained With Free PDF Download

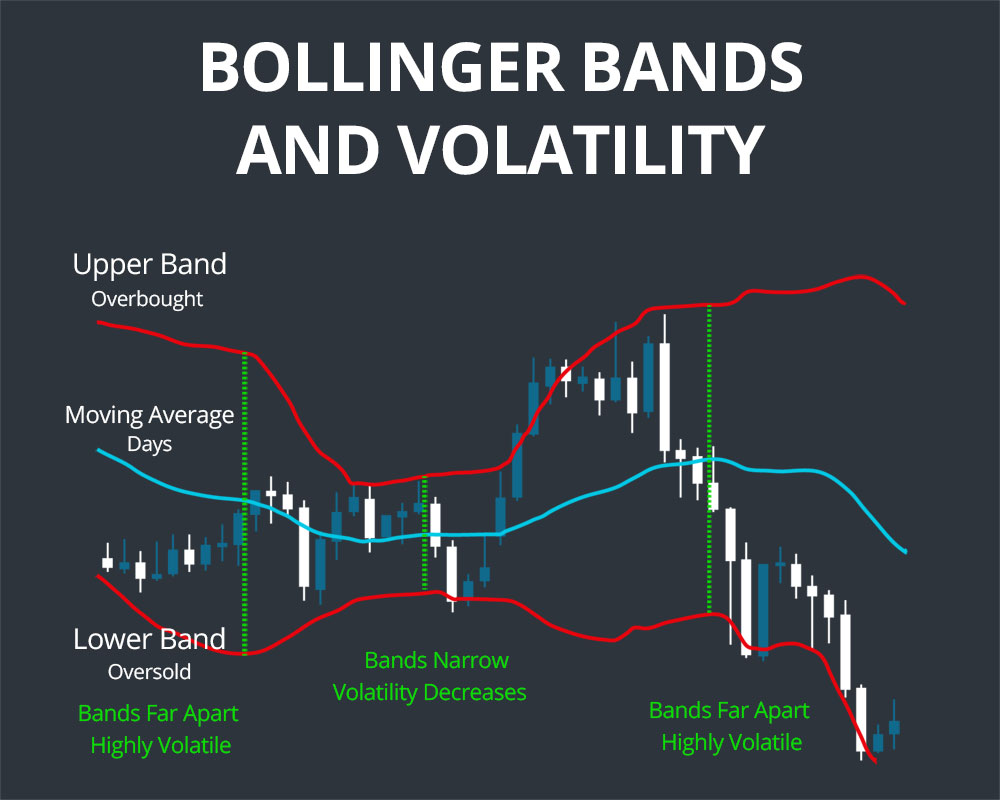

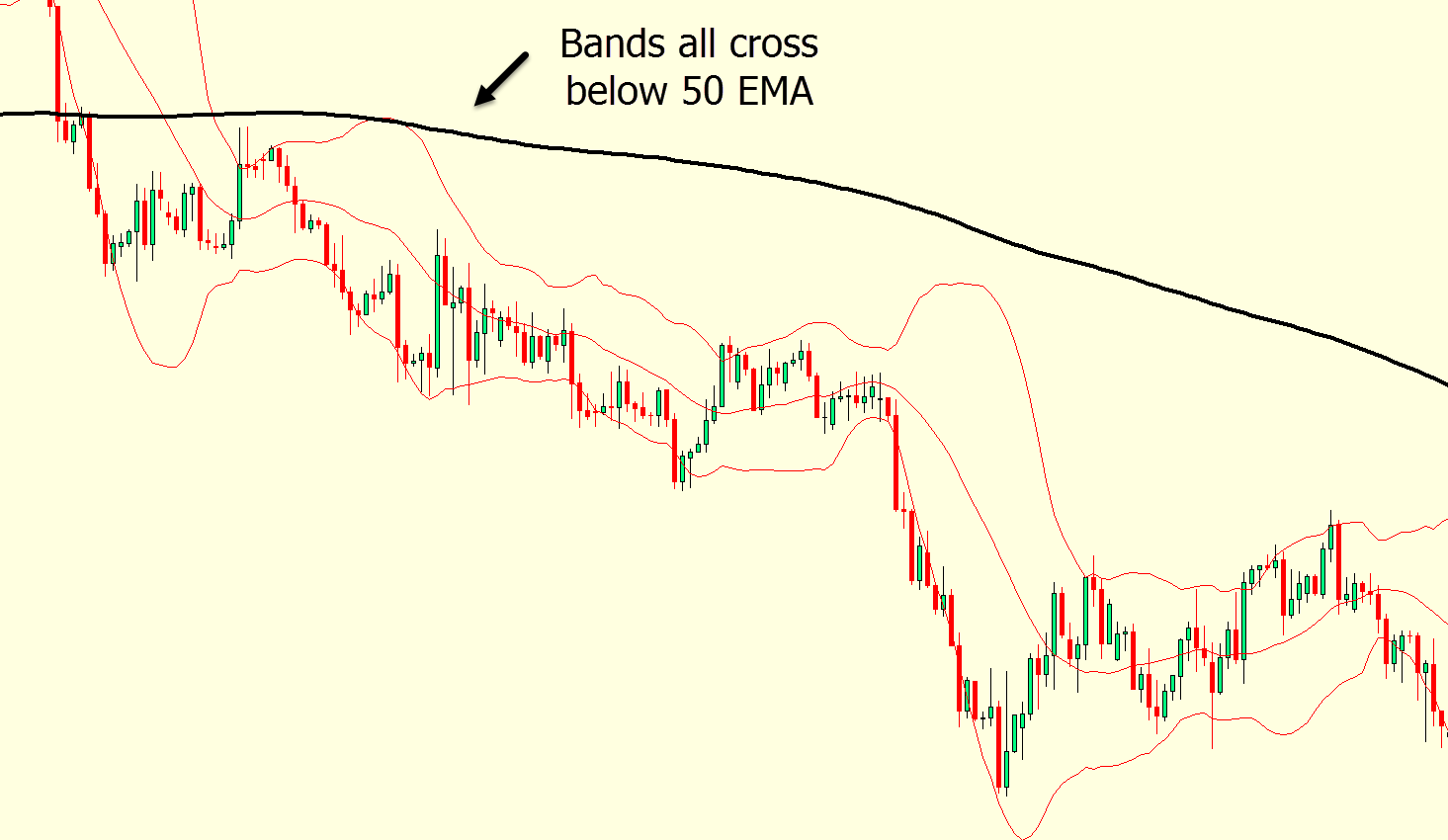

Developed by John Bollinger, Bollinger Bands® are volatility bands placed above and below a moving average. Volatility is based on the standard deviation, which changes as volatility increases and decreases. The bands automatically widen when volatility increases and contract when volatility decreases.

Bollinger Bands PDF Teaching Mathematics

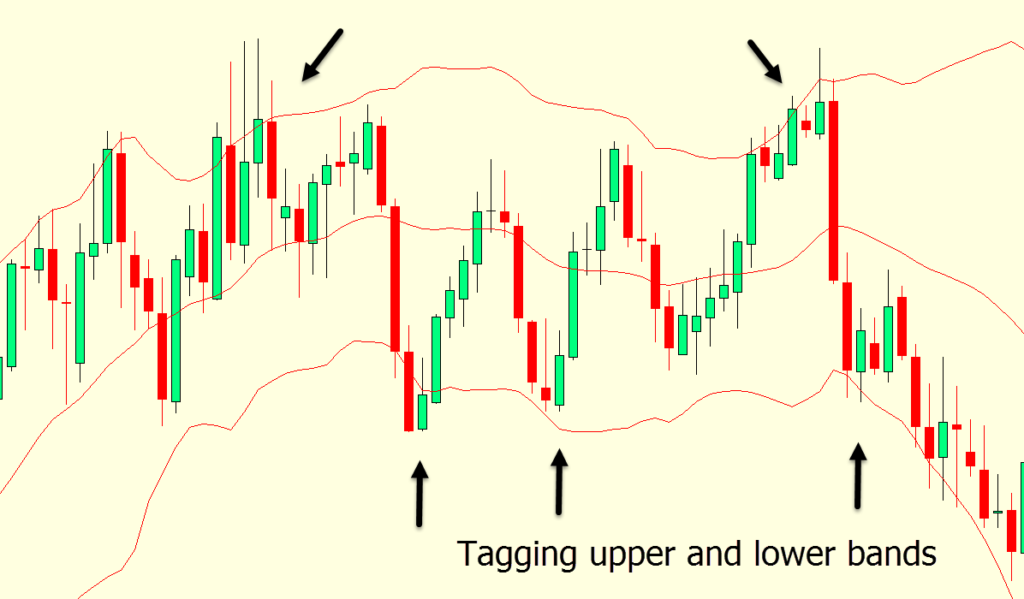

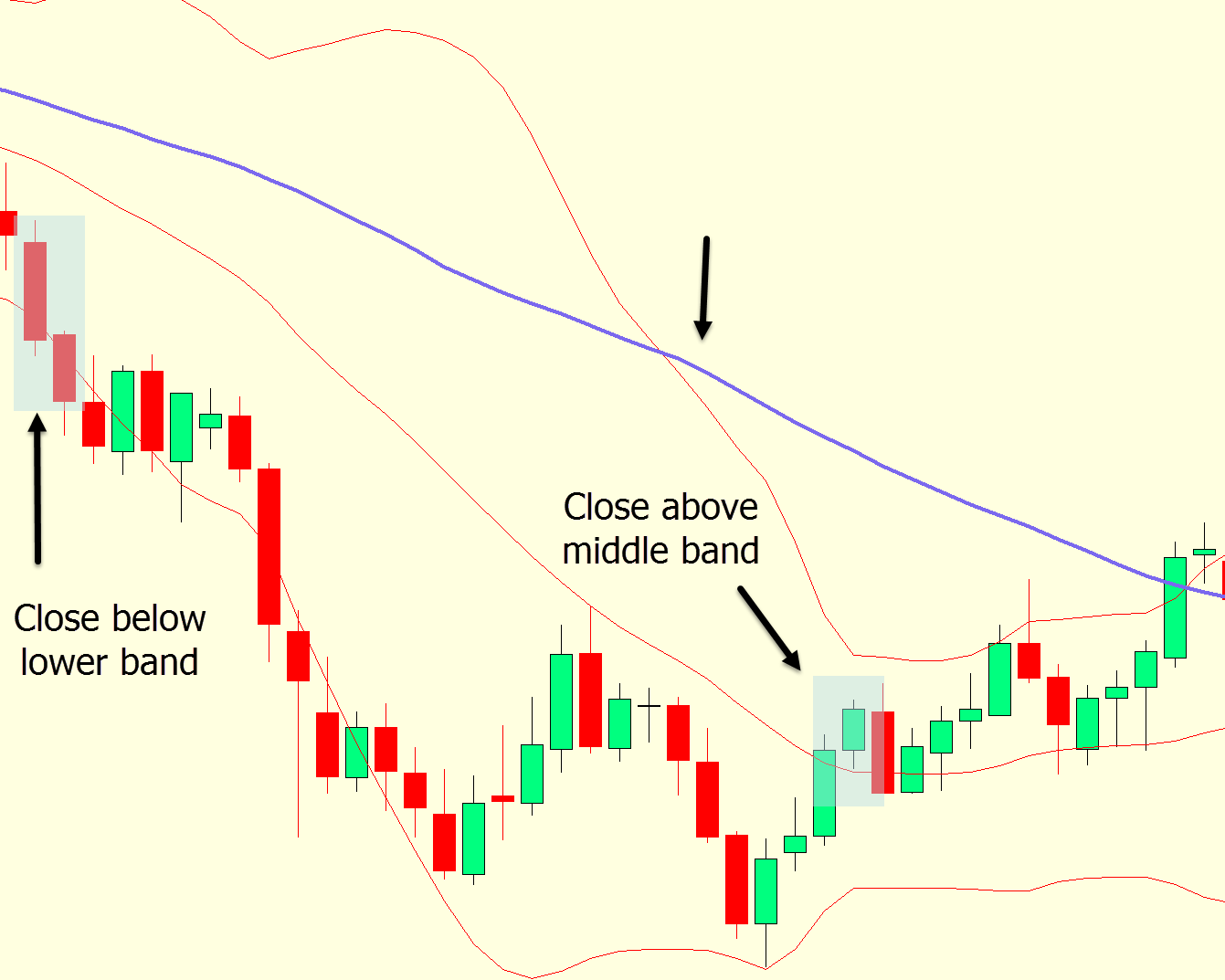

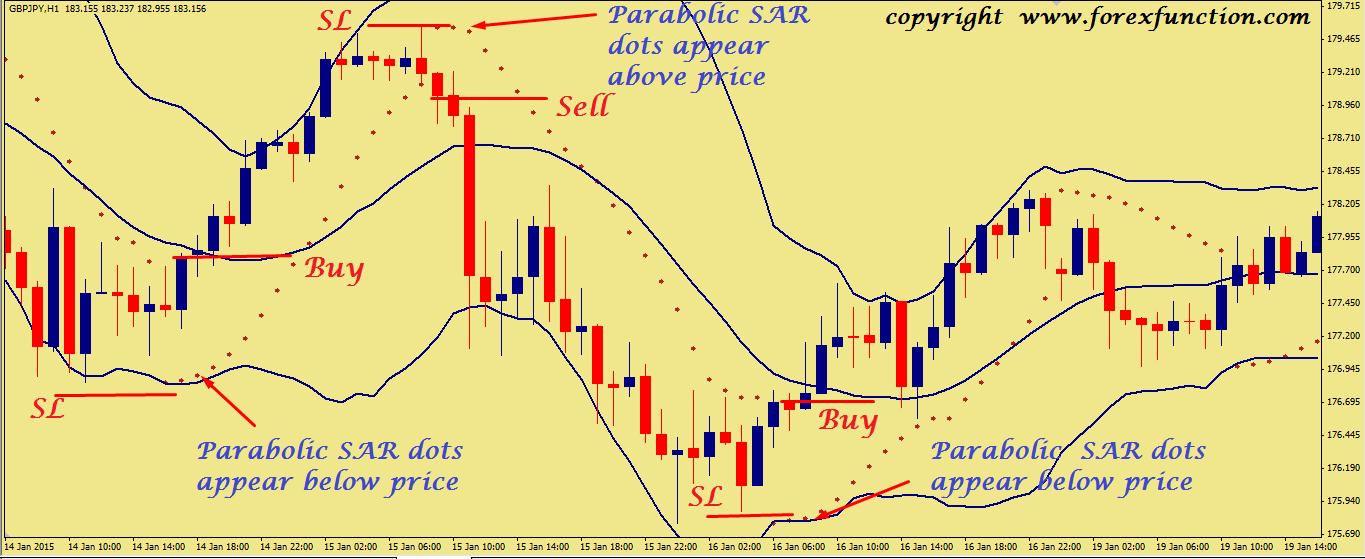

Summary What are Bollinger Bands? In practice, Bollinger Bands represent one of the most potent and reliable trading indicators in the world of technical analysis. This indicator is mainly used to interpret the strength of a trend and identify market tops or bottoms.

Bollinger Bands PDF

Bollinger Bands is a trading indicator (which consist of 3 lines) created by John Bollinger. It can help you: Identify potential overbought/oversold areas Identify the volatility of the markets Now you're probably wondering: "What do the 3 lines mean?" Upper band - Middle band plus 2 standard deviation

How to Use Bollinger Band Indicators Learn This Simple Trading Strategy

Bollinger Bands are one of the most common volatility indicators used in technical stock market analysis. The bands plot three separate lines on a price chart, with the outer two representing a.

Bollinger Bands Trading Strategy

Bollinger Bands are a useful and well known technical indicator, invented by John Bollinger back in the 1980s. They consist of a simple moving average (usually the 20 period) and two upper and bottom bands which are placed a number of standard deviations away (usually two).

Bollinger Bands là gì? Các chiến lược giao dịch sử dụng Bollinger Bands hiệu quả nhất

WTI WTI Bollinger bands are calculated using three lines that consist of the Simple Moving Average (SMA) of an asset price, upper band and lower band. Both upper and lower bands are plotted two standard deviations away from the SMA of an asset price.

Bollinger bands and macd pdf

Download 2 Bollinger Bands tutorials, books and PDFs for beginners and advanced traders from the Internet's largest collection of free trading books.

What is Bollinger Bands and How to use it

A Bollinger Band consists of a middle band (which is a moving average) and an upper and lower band. These upper and lower bands are set above and below the moving average by a certain number of standard deviations of price, thus incorporating volatility.